Luxury group Richemont has reported strong growth in the first quarter of the year, with the exception of China, where sales were impacted by Covid-19 restrictions. Similar to Burberry, Richemont saw strength in Europe, Japan, the Americas, and the Middle East, but faced challenges in the Asia Pacific region. Despite this setback, the company’s overall sales grew by 12% at constant exchange rates and 20% on a reported basis, reaching €5.264 billion.

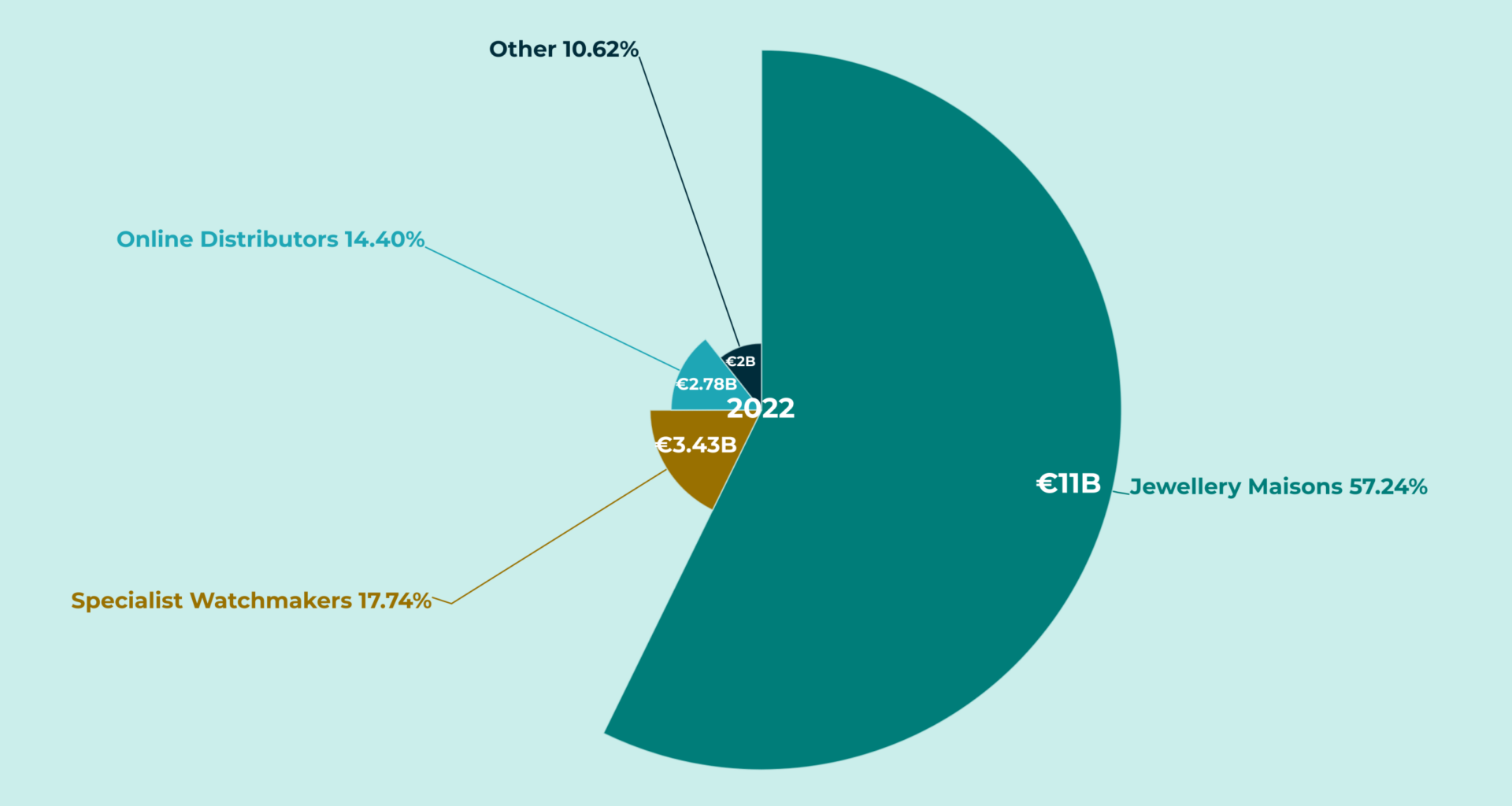

One of the key factors contributing to Richemont’s success was its strong performance in the US, which helped to offset the decline in China. The US has become Richemont’s largest single market. Retail was the leading driver of global growth, accounting for 58% of group sales compared to 55% in the previous year. Sales also increased across all channels and business areas. Jewellery Maisons saw a sales growth of 20%, while Specialist Watchmakers grew by 18%. Online Distributors, including Yoox Net-A-Porter, saw an 8% increase in sales. The Other business area, which includes the company’s fashion operations, experienced a strong progress of 36%.

By analyzing the sales figures, it is clear that Europe contributed €1.29 billion in sales, with a growth of 42% at constant exchange rates. In contrast, Asia-Pacific saw a decline of 15% with €1.78 billion in sales. The Americas rose by 25% to €1.344 billion, Japan increased by 83% to €421 million, and the Middle East/Africa saw a 6% growth to €429 million.

Richemont attributes its success in Europe to strong domestic demand and a return in tourist spending, particularly from American and Middle Eastern clients. The company experienced significant growth across markets, with particularly impressive sales increases in France. In mainland China, sales were 37% lower for the quarter, but the rate of decline softened to 12% in June as restrictions gradually eased. Although the decline in China affected overall sales in the region, Richemont saw encouraging momentum in other Asian markets such as Australia, Singapore, South Korea, and Thailand.

In the Americas, sales increased by 25% despite challenging comparisons to the previous year. This growth was driven by strong domestic spending. Retail sales played a significant role in Richemont’s success, with a growth of 18% at constant exchange rates. Online retail also saw a 5% increase, while wholesale and royalty income rose by 4% to €1.3 billion.

Richemont attributes its overall growth to its diverse portfolio of luxury brands, which includes Chloé, Dunhill, Alaïa, Cartier, and Delvaux. The company highlighted the strong performance of Peter Millar and Delvaux, as well as the positive impact of new designers at Alaïa, Chloé, and Montblanc.

Despite the challenges faced in certain regions, Richemont’s strong performance and growth in key markets indicate its resilience in the luxury sector. With a focus on retail and innovation, the company remains well-positioned to capitalize on the recovery of the global luxury market.

Useful links:

– Richemont Official Website

– Burberry’s Decline in China Sales